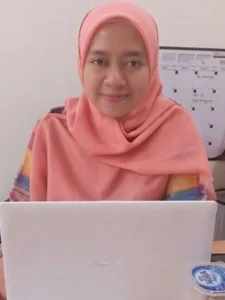

Home » Tita Nursyamsiah, M.Ec

| No. | Year | Research Title | Research Funding | Assignment |

| 1 | 2021 | Study of Bank Wakaf Mikro (BWM) Business Model | Financial Service Authority (OJK) | Team member |

| 2 | 2021 | Islamic Social Finance Insurance | The Indonesia Ministry of Finance | Team member |

| 3 | 2020 | Public Perception of BAZNAS during the Covid-19 Pandemic | National Zakat Amil Agency (BAZNAS) | Team member |

| 4 | 2019 | Mapping Study of Waqf Asset Development Potential in Bogor City

and its Surroundings |

National Islamic Economic and

Finance Committee |

Team member |

| 5 | 2019 | Study on Development of Regional Halal Agribusiness Indicator and

Its Application in Indonesia |

National Islamic Economic and

Finance Committee |

Team member |

| 6 | 2019 | Analysis of the Performance and Impact of the Kampung Qur’an

Program |

PPPA Daarul Quran | Team member |

| 7 | 2018 | Market Expansion and Inclusion through the Islamic Pension Program | Financial Service Authority (OJK) | Team member |

| 8 | 2017 | Impact of Inisiatif Zakat Indonesia (IZI) on Mustahik’s Welfare | Inisiatif Zakat Indonesia (IZI) | Team member |

| 9 | 2017 | Impact of Paytren on Partner’s Welfare | Paytren Indonesia | Team member |

| 10 | 2016 | Mapping the Potential of National Islamic Insurance | Financial Service Authority (OJK) | Team member |

| 11 | 2014 | Study of Islamic Micro Banking Business Models in the Context of

Increasing Access to Islamic Financial Services |

Financial Service Authority (OJK) | Team member |

| 12 | 2014 | Development of the Deposit Insurance Scheme for Islamic Banking

Industry |

Indonesia Deposit Insurance Corporation | Team member |

Publication

Certification

| No | Year | Title of Certificate | Certificate Number |

|---|---|---|---|

| 1 | 2022 | Certificate of Competence Halal Product Assurance | No. 74909 1321 0 0002956 2022 |

Awards

| No | Year | Awards Title |

|---|---|---|

| 1 | 2013 | Best Paper in The 2nd Islamic Economics and Finance Research Forum 2013 |

Copyright ©2024 Departemen Ilmu Ekonomi Syariah IPB by Garap Digital. All Rights Reserved.